Smart Accounting & Tax Solutions for Small Businesses & Individuals in the UK

What Clients Say About

AccoBee

Even the all-powerful Pointing has no control about the blind texts it is an almost unorthographic life One day however a small line of blind text by the name of Lorem Ipsum decided to leave for the far World of Grammar. The Big Oxmox advised her

Outsource Your Bookkeeping

& Reclaim Your Time

Grow your business while we handle the numbers. Fast, secure, and fully HMRC-compliant

bookkeeping services tailored to your needs.

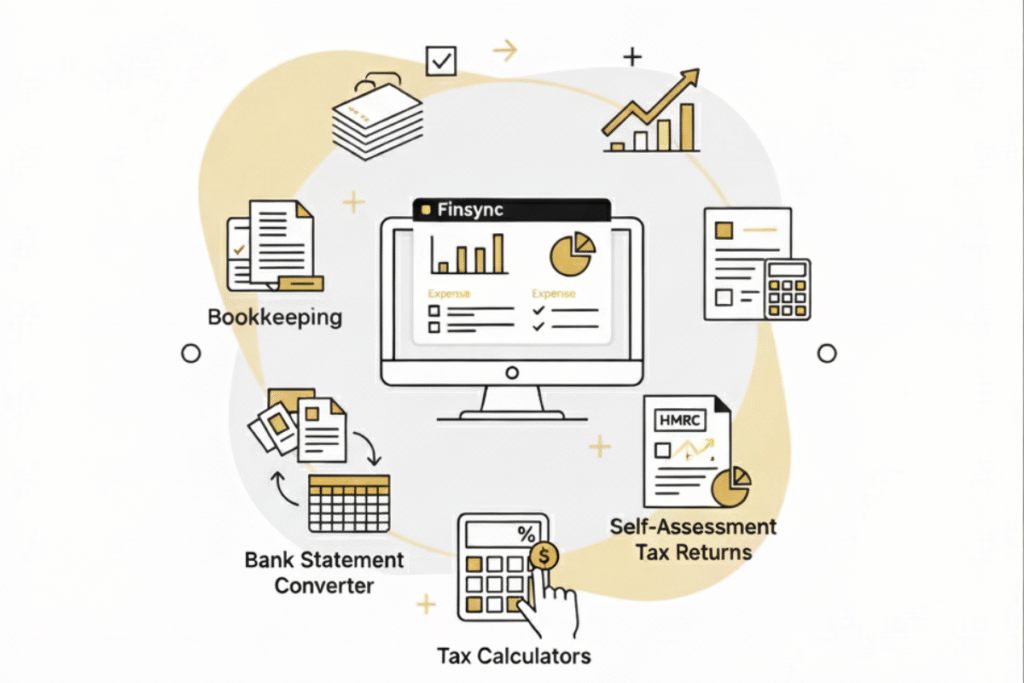

How AccoBee Simplifies Your Finances

We combine expert support with smart tools to make the entire process simple, accurate, and hassle-free.

Gather Your Business Data

You share your bookkeeping records, receipts, or tax details in the way that’s easiest for you. Our Bank Statement Converter and digital tools ensure everything is organised quickly and accurately.

We Organise & Analyse

Our team reviews your data using Finsync software to categorise expenses, and prepare your accounts. With advanced automation, errors are minimised, and everything stays compliant with HMRC.

Submission to HMRC & Companies House

You’ll receive easy-to-understand reports, tax calculations, and recommendations. For self-assessment, we prepare everything so you can submit your tax return with confidence and peace of mind.

All-in-One Bookkeeping and SATR Support

Our all-in-one accounting and tax service is designed for individuals, freelancers, and small businesses across the UK. From keeping your books accurate to filing your self-assessment tax return, we take care of it all. With AccoBee, you get expert guidance and innovative tools that save time, reduce errors, and give you peace of mind.

✔ Accurate Bookkeeping | ✔ Self-Assessment Tax Returns

✔ Finsync Finance Management Software

✔ Bank Statement Converter

✔ Income Tax & Dividend Tax Calculators

✔ Expert Guidance & HMRC Compliance | ✔ Fully Online & Hassle-Free Process

Why Choose AccoBee Accountants & Bookkeepers?

AccoBee don’t just provide services—we build trust, simplify processes, and deliver solutions that truly work for you.

Personalised Approach

We understand that no two clients are the same. Whether you’re a freelancer or a small business owner we tailor our services to fit your unique needs.

Technology-Driven

With our innovative tools like Finsyn and the Bank Statement Converter, we bring automation and simplicity to your accounting & finance.

Trusted Expertise

From handling complex bookkeeping to ensuring accurate, penalty-free tax submissions, our team makes sure your finances are always in safe hands.

Transparent & Reliable

Our pricing is fair, our process is straightforward, and our communication is always clear. You’ll know exactly what you’re getting, and how it benefits you.

Time-Saving Efficiency

We know your time is valuable. That’s why we’ve designed our services and tools softwares to be fast, efficient, accurate and stress-free.

Future-Focused Innovation

AccoBee continues to develop smarter solutions to help businesses that evolve with your needs and the changing financial landscape in the UK.

Who We Work With?

Small Businesses

Self Employed

Sole Traders

Company Directors

Landlords

Digital Nomads

Construction Workers

Contractors

E-Commerce

Frequently Asked Questions

Explore our faqs section to get quick answers to your questions.

Self Assessment is the system HMRC uses to collect Income Tax. Instead of tax being automatically deducted, you report your income and expenses in a tax return. You may need to file one if you’re self-employed, a sole trader, a company director, a landlord, or earn income outside of PAYE.

Filing early gives you peace of mind and avoids last-minute stress. It also lets you know how much tax you owe well in advance, so you can plan your finances or set up a payment plan if needed. HMRC also tends to be less busy earlier in the year, so issues are resolved faster.

If your records are well-organised, completing a Self Assessment can take just a few hours. However, gathering documents, double-checking income, and ensuring accuracy can take longer. With AccoBee, we streamline the process using our tools like the Bank Statement Converter and ensure everything is filed correctly and on time.

31 October (for paper returns)

31 January (for online returns and payment)

For example, the return for the 2024–25 tax year is due by 31 January 2026 if filing online. Missing deadlines can result in HMRC penalties.

You can pay HMRC directly via:

Online or telephone banking

Debit or corporate credit card online

Bank transfer

At your bank or building society (with a payslip)

Direct Debit (if already set up)

AccoBee provides guidance on the most convenient payment option for your situation.

Bookkeeping helps you track income, expenses, and cash flow, ensuring your business stays financially healthy. It also makes it easier to prepare tax returns, avoid compliance issues, and make smarter financial decisions.

Outsourcing saves you time, money, and stress. Instead of juggling numbers, you can focus on running your business while experts keep your records accurate. At AccoBee, we combine expertise with smart tools like Finsync to give you real-time financial clarity.

You can keep records manually (receipts, invoices, spreadsheets) or digitally using accounting software. HMRC recommends digital record-keeping, especially with Making Tax Digital (MTD). Tools like Finsync and our Bank Statement Converter make the process much easier and HMRC-compliant.

Bookkeeping fees vary depending on the size of your business and the complexity of transactions. In the UK, small businesses typically pay £50–£250 per month. At AccoBee, we offer transparent, tailored packages with no hidden costs.

Bookkeeping is the process of recording day-to-day financial transactions like sales, purchases, and expenses.

Accounting takes those records, analyses them, and provides insights, financial reports, and tax planning.

In simple terms: Bookkeeping is about keeping accurate records, while accounting is about making sense of those records.